In a recent report from Bloomberg Law, the official committee of unsecured creditors for Avant Gardner (the parent company of the Brooklyn Mirage) has withdrawn its support for a previously agreed-upon deal that would have allowed the venue’s primary lender, Axar Capital Management LP, to take over the business. This reversal threatens to derail the Chapter 11 reorganization process just months after a settlement was initially hailed as a “remarkable” outcome for creditors. This news comes just after the announcement of the sale of the venue to Pacha New York.

Key Developments

The creditors’ committee, which had initially backed Axar’s $110 million “credit bid,” filed a motion expressing concerns that the lender is no longer acting in the best interest of the estate or the unsecured creditors.

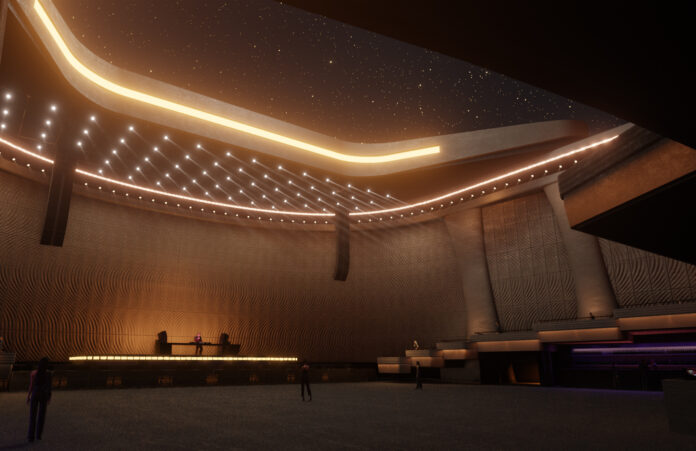

A central point of contention involves the physical state of the Brooklyn Mirage. While Axar had indicated plans to rehabilitate the venue for the 2026 season, new disagreements have surfaced regarding the funding and execution of the demolition and reconstruction of the massive outdoor stage.

The committee has raised concerns about “concerning issues” that have emerged in the weeks following the initial settlement. They are now seeking to “restore integrity” to the proceedings, suggesting that the previous deal may not provide the level of recovery for general unsecured creditors (GUCs) that was originally promised.

The original settlement was valued at over $20 million and included Axar’s commitment to fund administrative expenses, tax claims, and wind-down costs. By pulling support, the committee is effectively challenging the “stalking horse” bid and potentially opening the door for a court-appointed trustee to take control of the company.

The withdrawal of support likely leads to a hearing in the U.S. Bankruptcy Court for the District of Delaware. If the court agrees with the creditors, the sale to Axar could be blocked, potentially forcing a liquidation or a search for a new buyer who is willing to pay more or offer better terms to the unsecured creditors.